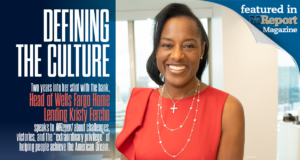

Two years into her stint with the bank, Head of Wells Fargo Home Lending Kristy Fercho speaks to MReport about challenges, victories, and the “extraordinary privilege” of helping people achieve the American Dream.

Read More »FHFA Releases Report Underlining FHLBanks’ Activities and Performance

The latest annual report from the FHFA revealed that an estimated $352.4 million in total contributions to the Affordable Housing Program was awarded in 2021, which assisted more than 32,000 low- and moderate-income households.

Read More »Study: Fewer Homeowners Planning to Utilize Tappable Equity

According to TD Bank's 2022 Home Equity Trend Watch survey, many Americans have more equity in their homes than ever before, as new data showed that nearly 50% of homeowners know how much tappable equity is available on their home but have yet to or no plans to tap into it.

Read More »Consumer, Median Mortgage Payments Rise in September

As escrow and title payments turned negative in 2022, new data from Bank of America showed that median mortgage payments rose nearly 9% in September, while total payments increased 10% year-over-year.

Read More »Rent Growth Cools to Slowest Annual Pace in Over a Year

After more than a year of double-digit yearly rent gains, the U.S. median rental price in September posted its smallest year-over-year increase since last summer, further declining from its peak in July 2022.

Read More »Which ZIP Codes Are Changing From Homeowner to Renter Majorities?

Amid inflated mortgage rates and a nationwide housing affordability crisis, the "American Dream" may seem far-fetched for many. The latest analysis from RentCafe showed that renting is at the highest level in half a century, with nearly 44 million households currently living in rentals.

Read More »Higher Education Proving Strong Contributing Factor for Millennial Homeownership

The latest analysis from First American Financial revealed that millennials are the most educated generation in American history, with nearly 40% possessing a bachelor’s degree or more, as those with higher education remain more likely to obtain homeownership.

Read More »Natural Disasters: Which States Are Being Hardest Hit Economically?

The number of climate-disaster damage is on the rise according to WalletHub's latest market report. The report examines which states are most impacted by natural disasters, with Hurricane Ian now projected to have done as much as $57 billion in damage to Florida and South Carolina.

Read More »Housing Sentiment Slips Again, Nears Record Low

According to Fannie Mae's Home Purchase Index, the percentage of Americans that believe now is a good time to buy a home decreased alongside those who expect mortgage rates to go down in the next year. Meanwhile, the percentage who say it is a bad time to buy increased to 75%.

Read More »Redfin Study Reveals Pullback in Homebuying Demand

While home prices remain elevated due to low supply, mortgage rates shot up to a 15-year high resulting in homebuyers losing nearly 30% of their purchasing power since rates reached their lowest point in 2021.

Read More » theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news