In a letter to the Federal Housing Finance Agency, the National Association of Federal Credit Unions is urging the FHFA to keep the conforming loan limit at its current baseline rate of $417,000 and not let the limit drop any lower, citing that this change could interrupt a still-recovering housing market.

Read More »HUD Reviews Castro’s First Year of Progress Since His Secretarial Induction

During his first year as the nation's top housing official, Castro has made several policy changes with the intent of increasing opportunity for more Americans to obtain affordable, sustainable housing. Several of those changes are outlined in an announcement from HUD on Monday including helping families and individuals secure quality housing, ending homelessness, and offering housing opportunities to all Americans.

Read More »Cash Sales Share at Lowest Point Since 2008

The share of cash sales in the housing market have dropped to their lowest point since September 2008. According to the CoreLogic July 2015 MarketPulse report, cash sales made up 33.7 percent of total home sales in April 2015, a decrease from 37.4 percent in April 2014.

Read More »Republican Presidential Candidate Weighs In on Fair Housing Rule

Republican presidential candidate Ben Carson discusses how busing failed to address the lack of a racial utopia in America, but the Obama administration has recently implemented a new HUD rule that will "desegregate" housing.

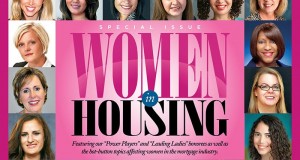

Read More »MReport Announces its 2015 “Power Players” & “Leading Ladies” Honorees

MReport’s August 2015 ‘Women in Housing’ issue highlights the accomplishments and achievements of the working women in the housing industry. In this issue, MReport introduces their 2015 “Power Players” and “Leadings Ladies” that are revolutionizing the industry. This issue is also dedicated to the issues women face in trying to obtain the dream of homeownership and a mortgage loan.

Read More »National HPI Inches Closer to June 2006 Peak

Black Knight Financial Services' Data and Analytics division released its May 2015 Home Price Index report. The report, which examines residential real estate transactions found that U.S. home prices were up 1.1 percent in May, increasing 5.1 percent on a year-over-year basis.

Read More »Proposal to Limit Salaries for Top GSE Executives Advances in Committee

The House Financial Services Committee has announced that proposed legislation to cap the salaries of CEOs at Fannie Mae and Freddie Mac has advanced to the markup phase, which will take place in the Committee on Tuesday, July 28.

Read More »Home Prices Recover to Near Pre-Crisis Levels

The Federal Housing Finance Agency recently determined that the U.S. Purchase-only House Price Index has recovered to pre-crisis levels recorded in April 2006, leaving the national index of house prices just 1.8 percent below the peak level of May 2007.

Read More »Appeals Court Revives CFPB Constitutionality Lawsuit

On Friday, a federal appeals court revived a lawsuit that challenged the constitutionality of the Consumer Financial Protection Bureau. According to multiple media reports, the U.S. Court of Appeals for the District of Columbia Circuit ruled that a Texas bank had legal standing to proceed with a lawsuit arguing the structure of the CFPB is unconstitutional.

Read More »June Residential Sales Volatile, But Still Strong

In June, new single-family home sales dropped below the rate in May, but remain strong on a year-over-year basis, according to HUD and the U.S. Census Bureau's joint release of their June New Residential Sales data on Friday.

Read More » theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news