“The higher the mortgage rate, the more sellers will go on strike and the more potential buyers will feel the impact of reduced house-buying power, but price appreciation will further slow and potential buyers can use adjustable-rate mortgages to regain some of that lost house-buying power,” said Mark Fleming, First American’s Chief Economist.

Read More »Learning to Pivot

As the population continues to grow and single-family home builds slip, multifamily builds and build-to-rent are hitting historic highs.

Read More »Rent Growth Expected to Moderate Further Into 2023

While rising supply is causing rent growth to slow, Redfin’s latest market report revealed rent growth experienced its first single-digit increase in a year, marking a significant slowdown from the estimated 20% growth in Q1. Here are the latest findings.

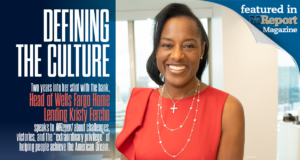

Read More »Defining the Culture

Two years into her stint with the bank, Head of Wells Fargo Home Lending Kristy Fercho speaks to MReport about challenges, victories, and the “extraordinary privilege” of helping people achieve the American Dream.

Read More »Rising Rates Leave Fewer Affordable Home Options

Those looking to stretch their budget as far as possible are not seeing any relief as affordability continues to decline amid an environment of rising rates and high home prices.

Read More »Fannie Mae: Q3 Home Price Growth Decelerates

“Year-over-year home price growth decelerated in the third quarter, as the sharp rise in mortgage rates—and declining housing affordability—appears to have weighed further on demand,” said Doug Duncan, Fannie Mae’s SVP and Chief Economist.

Read More »Study: Fewer Homeowners Planning to Utilize Tappable Equity

According to TD Bank's 2022 Home Equity Trend Watch survey, many Americans have more equity in their homes than ever before, as new data showed that nearly 50% of homeowners know how much tappable equity is available on their home but have yet to or no plans to tap into it.

Read More »Agencies Update Financial Exemption Requirements for 2023

Special appraisal dollar-amount limits, along with thresholds for Regulation Z and Regulation M, were adjusted by the CPFB to better reflect the current economic environment.

Read More »Consumer, Median Mortgage Payments Rise in September

As escrow and title payments turned negative in 2022, new data from Bank of America showed that median mortgage payments rose nearly 9% in September, while total payments increased 10% year-over-year.

Read More »Mortgage Rates Deter an Increasing Number of Homebuyers

Redfin reports that housing market activity is plunging further this fall than it did over the summer, with increased concern over 20-year high mortgage rates compounded by a volatile U.S. economy.

Read More » theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news