Outstanding residential acquisition, development, and construction loan volume expanded 4.7 percent in the second quarter of 2015. The National Association of Home Builders found that AD&C loans grew for the ninth consecutive quarter, but availability of these loans remains tight, hindering home construction.

Read More »Origination Credit Quality Lowers Mortgage Delinquency Rates

All mortgage originations, measured by loan count, jumped up to 1.48 million in Q2, which was an increase of 2.4 percent from the previous quarter and of 40 percent from the same quarter a year earlier.

Read More »Credit Unions Hold Largest Share of Mortgage Originations

Credit unions' market share of mortgage originations are experiencing a growth spurt in comparison to other financial institutions. TransUnion research released Tuesday found that credit unions' share of all mortgage originations has increased from 7 percent in Q1 2013 to 11 percent in Q1 2015.

Read More »Emerging ‘Disruptors’ to Fill Mortgage Industry Efficiency Gaps

With no fundamental changes to the origination process in decades, the lost efficiency, increasing costs and decreasing profits, combined with ever-merging regulatory hurdles, have left a gap in the mortgage industry to be filled by "disruptors."

Read More »Chase Downsizes Jumbo Loan Requirements

According to an announcement from the bank on Wednesday, Chase is simplifying its jumbo loan product offerings by lowering FICO and down payment requirements on loans as much as $3 million.

Read More »MReport Announces its 2015 “Power Players” & “Leading Ladies” Honorees

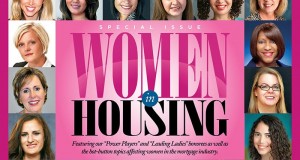

MReport’s August 2015 ‘Women in Housing’ issue highlights the accomplishments and achievements of the working women in the housing industry. In this issue, MReport introduces their 2015 “Power Players” and “Leadings Ladies” that are revolutionizing the industry. This issue is also dedicated to the issues women face in trying to obtain the dream of homeownership and a mortgage loan.

Read More »Flagstar Hires President of Mortgage

Flagstar Bancorp, Inc., recently announced that Leonard Israel has joined Flagstar as president of mortgage, where he will be responsible for all aspects of Flagstar's mortgage originations business. Israel will report to Flagstar President and CEO Alessandro DiNello.

Read More »Mississippi Ranked Among Best States to Get a Mortgage; New York Ranked Among Worst

Consumers that are looking to purchase a home must consider the varying mortgage rates and home prices in different states. GOBankingRates recently released a report, ranking all the states according to where it's easiest and cheapest to get a mortgage. The company reviewed all 50 states based on the local rates offered on 15-and 30-year fixed-rate mortgages in the first quarter of 2015, weighted with the average home listing price in the state.

Read More »Report Finds Overland Park is the Best City for First-Time Homebuyers; Compton Deemed the Worst

When purchasing a home, consumers often analyze the home further than just the outward appearance. WalletHub released a report on Monday, reviewing the level of attractiveness for cities all over the U.S. to determine how attractive a home is to first-time homebuyers. The report found that Overland Park, Kansas is the best city for first-time buyers, while Compton, California was labeled as the worst city for first-time buyers.

Read More »New Home Mortgage Applications & Refinance Applications Increase as Prices Recover

Mortgage applications for new home purchases and refinance applications both experienced increases as home prices recover, according to the Mortgage Bankers Association June 2015 Builder Application Survey and Weekly Mortgage Applications Survey for the week ending July 10, 2015.

Read More » theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news