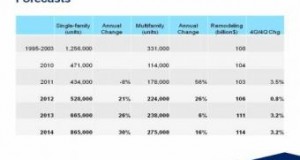

In a webinar hosted by the NAHB, economists discussed the housing recovery, what's keeping it going, and what may throw it off course.

Read More »Social Game Gives Players a Chance at $200K Mortgage Payoff

PopRox Entertainment's first game pits players in a contest to win real-life prizes, including a $200,000 mortgage payoff.

Read More »Report Predicts Slow Growth for Commercial Real Estate in 2013

The commercial real estate sector is improving, but investors need to be patient and not expect "quick wins," PwC and the Urban Land Institute said in a jointly-released report. According to their findings, "modest gains in leasing, rents, and pricing will extend across U.S. markets from coast to coast and improve prospects for all property sectors, including housing." Overall, recent job creation should bring down vacancy rates in the office, industrial, and retail sectors, and demand for apartments should remain.

Read More »Florida Housing Market Continues Upswing in September

As national home sales and prices showed mixed results for September, Florida's market posted higher sales, higher pending sales, higher median prices, and a slightly down inventory for the month. Statewide closed sales of existing single-family homes totaled 15,643 in September, up 2 percent year-over-year. Meanwhile, pending sales rose 40.1 percent in the same period to 21,368. The statewide median sales price for single-family homes was $145,000 in September, up 7.4 percent from a year ago.

Read More »Bipartisan Think Tank Launches Financial Regulatory Reform Initiative

At an event in Washington Thursday, the Bipartisan Policy Center (BPC) announced the launch of its new Financial Regulatory Reform Initiative to evaluate the financial regulatory system after the Dodd-Frank Act. The initiative is designed to assistant Congress, the executive branch, and regulators as they work to develop and modify financial supervision and regulation.

Read More »Study: Less than Half of State Settlement Money Being Used for Housing

Five servicers--Ally/GMAC, Bank of America, Citi, JPMorgan Chase, and Wells Fargo--agreed to a $25 billion penalty as part of the national mortgage settlement. Of that total, $2.5 billion was paid directly to the participating states. To date, states have announced plans to spend $966 million of the settlement money on housing- and foreclosure-related activities, according to Enterprise Community Partners, Inc. Another $988 million has been funneled toward general funds or non-housing ventures.

Read More »Home Prices, Sales Experience Monthly Slump in September

The housing sector hit a speed bump in September as existing home sales dipped, the National Association of Realtors revealed Friday. The association reported existing home sales fell 1.7 percent to a seasonally adjusted annual rate of 4.75 million, the first decline in three months. The median price of an existing home dipped 0.5 percent or $1,000 from August to $183,900, but is up 11.3 percent ($18,600) from September 2011, the strongest year-over-year dollar increase since January 2006.

Read More »Report: Construction Improving Most in Southeast

Six of the top 10 markets with the most single-family construction activity over the last year are located in Texas and the Southeast, according to a report from John Burns Real Estate Consulting. Because housing demand and employment are usually tied together, single-family permit growth has also meant job growth for many metros. Oklahoma City, Orlando, and Phoenix have all seen substantial employment growth (above 2.5 percent year-over-year) to match the rise in permits.

Read More »Fannie Mae: Housing Recovery to Withstand Economic Headwinds

In its October Economic Outlook report, Fannie Mae's Economic & Strategic Research Group pointed to financial and policy issues in the U.S. and abroad as looming challenges that could restrain meaningful economic growth in 2012. While the outlook on the economy was uncertain, the assessment for the housing market was more stable. Chief economist Doug Duncan said various indicators show "continued momentum toward a sustainable, long-term recovery," particularly the upward trend in home prices.

Read More »Capital Economics: Housing Future Similar Under Obama, Romney

When it comes to the continuation of current housing policies, both President Obama and Governor Romney largely agree.

Read More » theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news