This week, fixed-rate mortgages continued to drop to new 2016 lows reaching 3.41 percent making the 30-year fixed-rate mortgage just 10 basis points above its all-time record low of 3.31 percent reached in November 2012. Freddie Mac attributed this to continued fallout from the U.K.’s Brexit vote two weeks ago.

This week, fixed-rate mortgages continued to drop to new 2016 lows reaching 3.41 percent making the 30-year fixed-rate mortgage just 10 basis points above its all-time record low of 3.31 percent reached in November 2012. Freddie Mac attributed this to continued fallout from the U.K.’s Brexit vote two weeks ago.

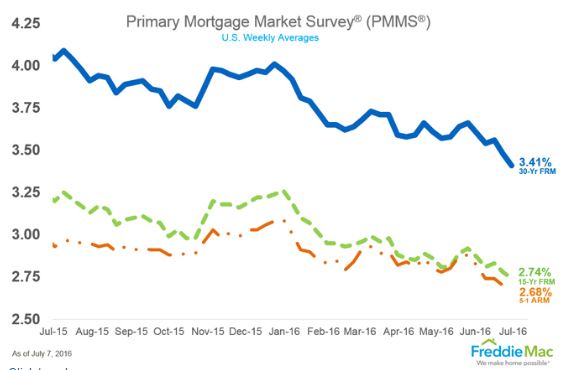

In the most recent Freddie Mac Primary Mortgage Market Survey (PMMS), [1] the average 30-year fixed-rate mortgage at 3.41 for the week ending July 7. This is even lower than last week when it averaged 3.48 percent. A year ago at this time, the 30-year FRM averaged 4.04 percent.

Additionally, the 15-year FRM this week averaged 2.74 percent with an average 0.4 point. That puts it lower than last week when it averaged 2.78 percent as well as a year ago at this time when the 15-year FRM averaged 3.20 percent.

"Continuing fallout from the Brexit vote drove Treasury yields lower again this week,” said Sean Becketti, the chief economist for Freddie Mac. “The 30-year fixed-rate mortgage followed Treasury yields, falling 7 basis points to 3.41 percent in this week's survey. Mortgage rates have now dropped 15 basis points over the past two weeks, leaving them only 10 basis points above the all-time low."

Following suit, the 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.68 percent this week with an average 0.5 point also down from last week when it averaged 2.70 percent and 2.93 last year.

Last week, Becketti was quoted saying “This extremely low mortgage rate should support solid home sales and refinancing volume this summer.” According to data from the Mortgage Bankers Association's (MBA) Weekly Mortgage Applications Survey for the week ending July 1, the mortgage applications increased 14.2 percent from one week earlier, establishing that Becketti’s predictions may be proven accurate.