Many loan origination systems are not satisfying the lenders who are using them, according to a the STRATMOR Group’s Insights report for December 2016 [1].

Many loan origination systems are not satisfying the lenders who are using them, according to a the STRATMOR Group’s Insights report for December 2016 [1].

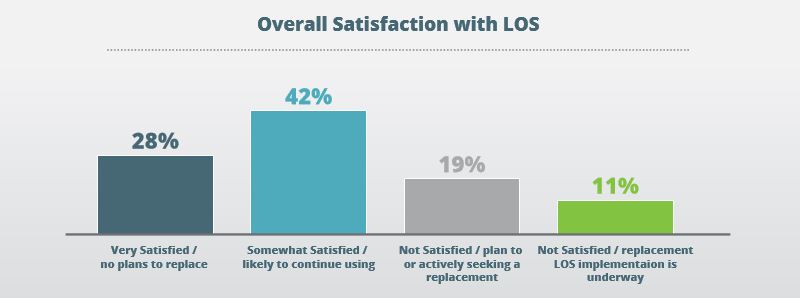

Nearly one-third of lenders surveyed (30 percent) said they were dissatisfied with their current LOS. Approximately 19 percent of lenders said they were actively seeking to replace their LOS, and another 11 percent said they were in the process of replacing their LOS because they were not satisfied with it, despite the disruption to business the replacement of an LOS can cause and the significant resources required for such a change, according to STRATMOR.

The share of lenders dissatisfied with their LOS in December was higher than the share reported in December 2015 (28.7 percent).

“Last year, the STRATMOR Technology Insight Survey found just over 27 percent of lenders were ‘very satisfied’ with their LOS,” STRATMOR Group Senior Partner Dr. Matt Lind said. “This year, the share who felt this way rose to 28 percent, a very modest increase. However, we find such a low rate of total satisfaction to be indicative of the decidedly mixed—if not downright depressing—results of this year’s survey. The largest group of respondents, 42 percent, indicated that they are just ‘somewhat satisfied.’ While not actively looking to replace their LOS, their responses indicate these lenders aren’t what you’d call ‘raving fans’ either. Over time we would expect many of these lenders to start to actively look for a new system.”

Why are these lenders dissatisfied with their systems? STRATMOR may have an idea. What the survey revealed was a correlation between the lender size and the amount of satisfaction (or dissatisfaction) with the LOS. System requirements and maintenance tend to be easier with smaller lenders’ systems since those lenders most often originate out of single channels, whereas larger lenders originate out of multiple channels, making it tougher for those systems to meet the challenge, according to STRATMOR.

“As companies grow larger, the demands on the system become more complex in terms of geography and origination channels,” STRATMOR reported. “The system needs of a correspondent lender are very different from that of a retail lender.”

Click here [1] to view the entire STRATMOR Group Insights report for December.