Lenders One Mortgage Cooperative has started 2012 on an optimistic note. The company recently announced that it achieved a new high for origination volume last year, giving Lenders One a record breaking end to 2011.

Read More »Provident Adds New Consumer Markets Leader

Provident Bank has appointed a new consumer markets leader for its northern and central regions, with the announcement that Colleen Sousa will join the financial institution.

Read More »Obama Touts Lower FHA Premiums, Vet Homeowner Relief

The Obama administration revealed recently it will relieve veterans wrongly foreclosed upon by servicers, as well as slashing refinancing rates for FHA loans.

Read More »Platinum Data Solutions Appoints New CEO

Platinum Data Solutions has named a new CEO, announcing that industry veteran Phil Huff will join the company following the retirement of the company's founder, Rocky Donathan, who was the previous CEO.

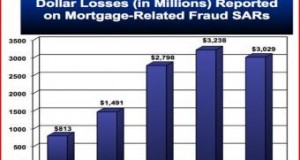

Read More »FBI: Suspicious Activity Reports Up for Mortgage Fraud

The mortgage fraud caseload rose last year as federal insurers reported more suspicious activity, according to new data from the Federal Bureau of Investigation.

Read More »NAHB Proposes Plan to Overhaul Secondary Market

A prominent housing trade group joined a growing roster of policy makers by outlining ways to take the GSEs off federal conservatorship, reintroduce private mortgage-backed securities, and charge existing government entities with stewardship of the new system. The National Association of Home Builders released a white paper Monday that calls on lawmakers to slowly transition a system dominated by Fannie Mae and Freddie Mac to one that shares and balances responsibility. The proposal comes as others arrive from lawmakers and policy makers to replace the GSEs.

Read More »Hamilton Financial Index Shows Strength Improving

Hamilton Place Strategies has released findings from its analytics initiative, the Hamilton Financial Index. The company releases its examination of the state of the U.S. financial services industry on a semi-annual basis, and Hamilton conducts the study on behalf of the Partnership for a Secure Financial Future.

Read More »Personal Income, Spending Up in January Shy of Expectations

Personal income rose 0.3 percent in January, compared with market expectations for an increase of 0.5 percent. Personal income grew 3.6 percent in the last year. Consumer spending grew 0.2 percent, compared with market expectations for an increase of 0.4 percent.

Read More »Housing Looms Large, As Ever, For Bernanke, Lawmakers

A hearing held by House lawmakers Wednesday with Federal Reserve Chairman Ben Bernanke recast housing and the Dodd-Frank Act as issues critical to the economic recovery. The central banker said that 30 percent of home sales recently consisted of foreclosures and properties in distress, reflecting ongoing trouble for a market underpinned by high home vacancy rates and downward pressure for home prices. The underwriting process, down payments, and pending regulations also took center-stage during the discussion, with House members spotlighting recent servicer consent orders.

Read More »PVTB Launches New Unit, Appoints New Leader

In Illinois, PrivateBancorp, Inc., has named a new president of personal client services. The financial institution recently appointed Brant Aherns to the leadership role, which marks the launch of a new line of business for PVTB.

Read More » theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news