Mortgage applications dipped last as long-term rates reached a five-month high, according to the Mortgage Bankers Association (MBA). MBA's weekly Market Composite Index showed a 6.4 percent drop for the week ending February 8. On an unadjusted basis, the index was down 5 percent. After showing some strength in the previous week, purchase application activity also dropped, falling by an adjusted 10 percent (or an unadjusted 4 percent). Year-over-year, however, volume was still up 15 percent.

Read More »California Sees Largest Rent Price Growth in 2012

RentRange, LLC, a Westminster, Colorado-based data and analytics provider for the single-family rental market observed changes in rent prices for three-bedroom, single-family homes located in cities with at least 25,000 residents. The data firm found the greatest growth in La Quinta, California, where rents increased 35.75 percent from December 2011 to December 2012.

Read More »FTC: 25% of Consumers Have Errors in Credit Reports

Nearly 20 percent of credit reports reviewed by consumers and experts, according to a congressionally mandated study by the Federal Trade Commission (FTC). The study, based on the findings of 1,001 participants reviewing 2,968 credit reports issued from Transunion, Experian, and Equifax, showed that approximately 25 percent of consumers identified errors material enough to affect their credit scores. About 5 percent found errors large enough to trigger higher payments for mortgages or other financial products.

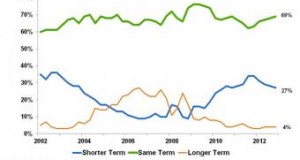

Read More »Freddie Mac: 27% of Q4 Refinancers Shortened Loan Terms

Data released by Freddie Mac shows more than a quarter of borrowers who refinanced in Q4 2012 chose to shorten their loan terms.

Read More »Freddie Mac Names New Board Member

Freddie Mac's board has a new member. The company announced the election of Steven W. Kohlhagen, Ph.D. to its board of directors. Kohlhagen brings more than three decades of experience with him, having held senior executive positions at leading financial institutions, including First Union National Bank (predecessor to Wachovia National Bank), American International Group, Stamford Capital Group, Bankers Trust Corporation, and Lehman Brothers.

Read More »CoreLogic: 60% of Today’s Loans Fail QM, QRM Requirements

About 60 percent of loans written today would be unacceptable under the finalized rules for a QM and the anticipated rules for a QRM, according to CoreLogic.

Read More »Mortgage Builder Renames Loan Servicing Software Platform

Mortgage Builder Software, a provider of loan origination and loan servicing software systems, is renaming its loan servicing software platform.

Read More »loanDepot Announces Executive Hires

loanDepot.com, LLC, an independent mortgage lender based in California, announced four additions to its executive lineup.

Read More »Mortgage Master Expands in Midwest with Chicago Branch, New Hires

Mortgage Master, a super-regional mortgage bank and one of the country's largest privately owned mortgage companies, announced it is expanding its geographic footprint into the Midwest with the opening of a new branch in Chicago. The company also announced the hiring of Brian Jensen as Midwest regional manager and Craig Achtzehn as area manager in the Chicago branch. The company also announced the hiring of Brian Jensen as Midwest regional manager and Craig Achtzehn as area manager in the Chicago branch.

Read More »NAR: End of 2012 Sees Gains in Prices, Sales, Affordability

According to the NAR, the depleting share of lower-priced homes is contributing to price growth as distressed sales--foreclosures and short sales--diminish. The association found the national median price for an existing single-family home rose to $178,900 in Q4, up 10 percent from the fourth quarter of 2011. The increase marks the biggest year-over-year gain since the fourth quarter of 2005, when the median price was up 13.6 percent. Existing-home sales improved as well in Q4, rising to a seasonally adjusted annual rate of 4.90 million.

Read More » theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news