In signs that a stable housing rebound may still be ways off, mortgage applications contracted by 1.2 percent last week, even while the Home Affordable Refinance Program offered a still-steady buttress for refinance activity. The Mortgage Bankers Association found in a weekly survey that mortgage application volume also declined by 10.2 percent on a seasonally adjusted basis. The Purchase Index went up by a seasonally adjusted 2.1 percent from last week, while it climbed by 14.7 percent on a seasonally unadjusted basis.

Read More »Lenders One Reports Record-Breaking Statistics

Lenders One Mortgage Cooperative has started 2012 on an optimistic note. The company recently announced that it achieved a new high for origination volume last year, giving Lenders One a record breaking end to 2011.

Read More »Provident Adds New Consumer Markets Leader

Provident Bank has appointed a new consumer markets leader for its northern and central regions, with the announcement that Colleen Sousa will join the financial institution.

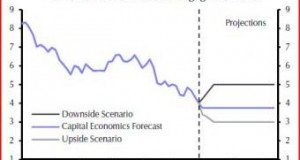

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Nationstar Signs Deal to Buy $63B in Aurora’s Servicing Rights

Nationstar Mortgage LLC seized a deal recently with Aurora Bank, formerly Lehman Brothers Bancorp, for a handover of $63 billion in residential mortgage servicing rights.

Read More »Mortgage Rates Ride Rollercoaster Ahead of Greek Deadline

All-time highs for housing affordability persisted this week as interest rates for fixed-rate mortgages hovered near their record-breaking lows, a sign that Europe continues to ward off investors. Real estate Web site Zillow found only a minor shift for the 30-year fixed-rate mortgage, which lingered between 3.70 percent and 3.75 percent before nestling at 3.69 percent Tuesday. The 15-year loan stayed near 2.95 percent, along with rates for 5-year and 1-year adjustable-rate mortgages that averaged 2.65 percent, according to the Web site.

Read More »Obama Touts Lower FHA Premiums, Vet Homeowner Relief

The Obama administration revealed recently it will relieve veterans wrongly foreclosed upon by servicers, as well as slashing refinancing rates for FHA loans.

Read More »Platinum Data Solutions Appoints New CEO

Platinum Data Solutions has named a new CEO, announcing that industry veteran Phil Huff will join the company following the retirement of the company's founder, Rocky Donathan, who was the previous CEO.

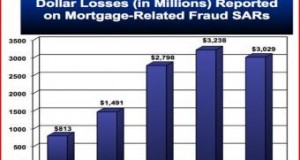

Read More »FBI: Suspicious Activity Reports Up for Mortgage Fraud

The mortgage fraud caseload rose last year as federal insurers reported more suspicious activity, according to new data from the Federal Bureau of Investigation.

Read More »Home Prices Expected to Continue Stabilizing: Fitch

Lower unemployment figures and higher GDP growth continue to help stabilize home prices amid a still-steady recovery, Fitch Ratings said Monday. The ratings agency found in a report that home prices may plunge 9.1 percent nationally but that the figures remain below estimates of 13.1 percent from the fourth quarter. Fitch said that declines may contract by around 6 percent in lieu of inflation and benefit from improvements in macro-economic indicators, such as unemployment and GDP growth. The report said that still-anemic mortgage volume remains a problem.

Read More » theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news